Kia has grown into one of the world’s most trusted automotive brands, recognized for producing stylish, reliable, and technologically advanced vehicles at competitive prices. For millions of drivers, the path to owning a Kia involves working with Kia Motors Finance (KMF)—the financial arm associated with Kia that provides consumers with leasing and financing solutions. Whether you are buying a new Kia, leasing your next vehicle, or managing an existing account, Kia Motors Finance plays a central role in helping customers secure flexible and affordable financing options.

This comprehensive guide breaks down everything you need to know about Kia Motors Finance, including its services, application process, payment tools, benefits, credit considerations, and tips for getting the best possible financing deal. If you’re shopping for a Kia or already a customer, this 2000-word article will serve as your go-to reference.

What Is Kia Motors Finance?

Kia Motors Finance is the financing provider that supports customers purchasing or leasing Kia vehicles through Kia-affiliated dealerships. While Kia Motors Finance is branded for Kia consumers, it is actually a part of a larger financial services network operated by a major auto finance company in the United States. Its primary mission is to make vehicle ownership convenient and financially accessible.

KMF offers three primary service categories:

Auto Loans (Retail Financing) – Long-term financing that allows customers to purchase and own their Kia vehicle.

Leasing Programs – Flexible lease options with mileage caps and end-of-term choices.

Account Management Services – Tools to pay bills, monitor loan status, and manage auto-pay or payoff requests.

With a streamlined user portal, promotional incentives, and strong dealership partnerships, Kia Motors Finance enhances the overall car-buying experience.

Financing vs. Leasing Through Kia Motors Finance

1. Financing a Kia Vehicle

Financing refers to taking out a loan to purchase your vehicle. With Kia Motors Finance, customers can:

Choose loan terms typically ranging from 24 to 72 months

Benefit from promotional interest rates such as 0% APR on select models

Make monthly payments that build equity in the vehicle

Pay off the vehicle anytime without prepayment penalty

Financing is ideal for customers who want long-term ownership, customization freedom, and no mileage restrictions.

2. Leasing a Kia Vehicle

Leasing has become a popular alternative to traditional auto loans, especially for consumers wanting lower monthly payments or frequent vehicle upgrades.

Through KMF, lease customers enjoy:

Lower monthly payments than traditional loans

Access to the latest Kia models every few years

Warranty coverage that typically lasts through the lease term

Multiple options at lease-end: buy the car, return it, or lease a new one

However, lease agreements may include mileage limitations and wear-and-tear assessments.

How to Apply for Financing with Kia Motors Finance

Applying for financing with Kia Motors Finance is straightforward. Whether online or at a dealership, the process involves several key steps.

Step 1: Check Your Credit Score

Your credit score determines:

Your interest rate

Required down payment

Approval odds

KMF works with a wide range of credit profiles, but higher scores yield better terms.

Step 2: Calculate Your Budget

Before applying, determine:

How much you can afford each month

The loan term that suits you

Trade-in value of your current car

Additional costs like taxes, insurance, and maintenance

Kia’s website offers affordability calculators to simplify planning.

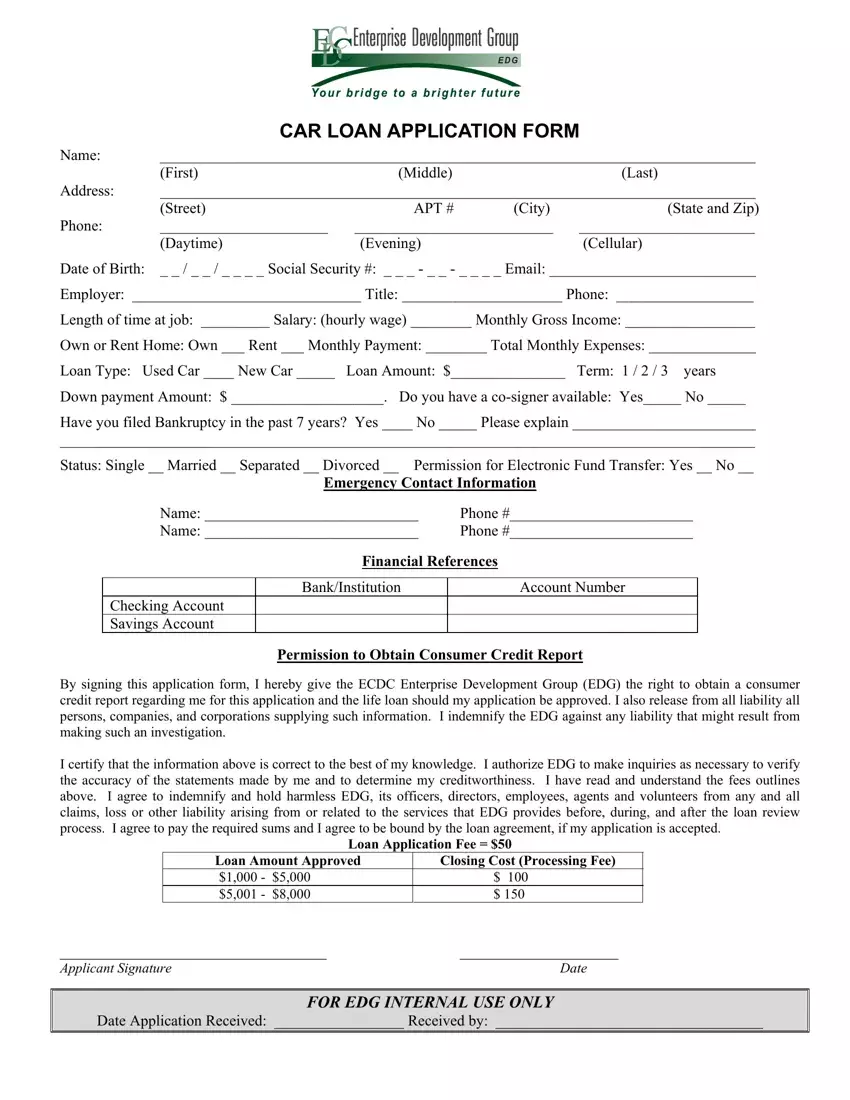

Step 3: Submit a Finance Application

Customers can apply in two ways:

Online Pre-Approval – Complete a secure form through Kia’s official website.

Dealership Application – Apply in person with help from a finance specialist.

Applications typically require:

Contact information

Employment and income details

Housing information

Social Security number

Step 4: Receive Approval and Discuss Terms

Once approved, customers can select from various loan or lease options, compare monthly payments, and review eligibility for promotions or rebates.

Step 5: Sign the Contract and Drive Away

After reviewing and signing your contract, you are ready to take delivery of your new Kia.

Key Features and Tools Offered by Kia Motors Finance

Kia Motors Finance provides several tools and services designed to simplify account management:

1. Online Account Management

Through the KMF online portal, customers can:

View loan or lease statements

Make one-time or recurring payments

Update personal information

Review payoff amounts

Download account documents

The dashboard is user-friendly and accessible 24/7.

2. Auto Pay Enrollment

Auto Pay ensures payments are made on time automatically, reducing the risk of late fees and credit score damage.

3. Payment Methods

KMF supports multiple payment options:

Online payments

Auto Pay

Phone payments

Mail-in checks

In-person dealership payments

4. Paperless Statements

Customers can opt for paperless billing to receive monthly digital statements.

5. Lease-End Management Tools

KMF prepares customers for their lease-end with:

Wear-and-tear inspections

Vehicle return locations

Early termination guidelines

Buyout options

Understanding Finance Terms and Conditions

When entering a financing or leasing agreement, customers should fully understand the terms. Key points include:

APR (Annual Percentage Rate)

APR represents the interest cost of borrowing money. Promotional APRs like 0% or 1.9% are often available for qualified buyers.

Loan Term Length

Longer terms reduce monthly payments but increase total interest paid. Kia offers flexible terms to fit various budgets.

Down Payment Requirements

Although KMF sometimes promotes “$0 down” offers, a down payment can reduce monthly installments and interest charges.

Residual Value (for Leases)

This is the estimated value of the car at the end of a lease. Higher residuals usually equal lower monthly payments.

Mileage Limits

Lease agreements may include annual mileage limits like:

10,000 miles

12,000 miles

15,000 miles

Exceeding mileage incurs additional charges.

Promotions and Incentives Through Kia Motors Finance

Kia is known for competitive financing programs, particularly for new vehicles. Common promotions include:

1. Low or Zero APR Financing

Select models qualify for special APRs such as 0% or 1.9% for well-qualified buyers.

2. Cash Rebates

Rebates reduce the vehicle’s price, which lowers total loan cost.

3. Lease Specials

Lease incentives may include:

Reduced monthly payments

Low or no security deposits

Bonus cash for new lessees

4. Military and Student Discounts

Kia often provides special discounts to:

Active-duty military

Recent graduates

First-time buyers

5. Loyalty and Conquest Programs

Returning customers or those switching from a competing brand may qualify for loyalty rewards.

Managing Your Kia Motors Finance Account

Once your loan or lease is active, proper management is essential. Kia Motors Finance offers straightforward tools to stay on track.

Make Payments on Time

Late payments can result in:

Late fees

Higher interest costs

Credit score impacts

Using Auto Pay is highly recommended.

Monitor Your Loan Balance

The online portal shows real-time payoff amounts, helpful if you plan to:

Sell your car

Refinance

Trade it in early

Lease-End Preparations

If leasing, begin preparing months before your term ends:

Schedule a pre-return inspection

Decide whether to buy or return your Kia

Review excess mileage and wear guidelines

Understanding Payoff Procedures

If you want to pay off your loan early, KMF provides a payoff quote with instructions. Paying off early may save on future interest.

Credit Requirements for Kia Motors Finance

While Kia Motors Finance works with a wide range of credit scores, terms vary based on your financial profile.

Excellent Credit (750+)

Lowest APR rates

Best lease terms

Higher chance of approval

Good Credit (670–749)

Competitive terms

Moderate interest rates

Strong approval likelihood

Fair Credit (580–669)

Higher rates

Possible need for a co-signer or larger down payment

Poor Credit (Below 580)

Approval is possible but challenging

Higher down payment requirements

Higher interest rates

Kia dealerships often work with additional third-party lenders for customers who do not qualify through KMF.

Advantages of Using Kia Motors Finance

Working directly with Kia’s financing arm provides several unique benefits:

1. Seamless Dealership Integration

The entire process—from application to approval—is streamlined through Kia dealerships.

2. Exclusive Incentives

Promotional APRs, rebates, and lease deals are exclusive to KMF customers.

3. Flexible Terms

Kia offers options tailored to both low-payment seekers and fast payoff customers.

4. Reliable Online Portal

Payment management is simple, intuitive, and secure.

5. Lease-Friendly Programs

KMF specializes in flexible, affordable leases for customers who prefer upgrading frequently.

Potential Drawbacks of Kia Motors Finance

While KMF offers many benefits, customers should be aware of potential limitations.

1. Limited to Kia Purchases

Financing is only available for Kia vehicles purchased through authorized dealerships.

2. Promotional Rates Require Strong Credit

The best offers typically require excellent credit profiles.

3. Leasing Can Become Expensive

Extra mileage or wear charges can add up if the contract is not followed.

4. Interest Can Add Up on Longer Loans

Lower monthly payments often mean higher total costs due to interest.

Tips for Getting the Best Deal with Kia Motors Finance

To maximize savings and secure the best loan or lease terms, consider the following strategies:

1. Improve Your Credit Before Applying

A small increase in credit score can significantly reduce your APR.

2. Compare Loan Terms

Shorter terms reduce long-term costs but require higher payments.

3. Make a Larger Down Payment

This lowers your monthly payments and total interest.

4. Take Advantage of Promotions

Check Kia’s website regularly—promotions change monthly.

5. Negotiate the Vehicle Price Separately

Before discussing financing, negotiate the car’s purchase price to avoid paying more than necessary.

6. Review All Contract Details

Pay attention to:

APR

Total cost

Mileage limits

Fees

Careful review avoids surprises later.

Lease-End Options Through Kia Motors Finance

When your lease expires, you have three main options:

1. Return the Vehicle

Simply bring the vehicle back after completing your inspection and settling any fees.

2. Purchase the Vehicle

Pay the predetermined buyout amount and keep the vehicle permanently.

3. Lease or Finance a New Kia

Many customers choose to upgrade to a newer model using exclusive loyalty discounts.

Final Thoughts: Is Kia Motors Finance Worth It?

Kia Motors Finance offers a comprehensive range of services tailored to simplify the vehicle ownership process. Whether you’re financing your first car, leasing a new model, or managing an existing account, KMF provides user-friendly tools, competitive rates, and promotional incentives that enhance affordability.

For customers committed to purchasing a Kia, Kia Motors Finance is often the most convenient and cost-effective financing option. Its seamless integration with dealerships, exclusive programs, and strong customer service make it an appealing choice for both new and repeat buyers.

If you’re planning to buy or lease a Kia soon, taking the time to explore KMF’s incentives and terms can help you secure the best possible deal. With proper preparation, budget planning, and an understanding of your contract, Kia Motors Finance can make your vehicle ownership journey smooth, predictable, and financially manageable.

FAQ: Kia Motors Finance

1. What is Kia Motors Finance?

Kia Motors Finance is Kia’s official financial service provider offering auto loans, leasing programs, promotions, and account management tools for customers purchasing or leasing Kia vehicles. It simplifies the buying process and provides exclusive incentives through authorized dealerships.

2. How do I apply for financing with Kia Motors Finance?

You can apply online through Kia’s pre-approval application or complete the process at a participating Kia dealership. You’ll need basic personal information, employment and income details, and your Social Security number for credit review.

3. Does Kia Motors Finance approve bad credit?

Yes, KMF works with a wide range of credit profiles, but approval is not guaranteed. Applicants with lower credit scores may face higher interest rates or be asked for a larger down payment. Some dealerships partner with alternative lenders for subprime financing options.

4. What credit score do I need for Kia Motors Finance?

While there is no minimum score required, applicants with a credit score of 670+ generally qualify for favorable rates. Scores above 750 typically receive the best promotional APRs and lease terms.

5. How do I make payments to Kia Motors Finance?

KMF supports multiple payment methods:

Online payments via the Kia Finance portal

Auto Pay (automatic recurring withdrawals)

Phone payments

Mail-in checks

In-person payments at select dealerships

Auto Pay is recommended to avoid late fees.

6. Does Kia Motors Finance offer Auto Pay?

Yes. Auto Pay automatically withdraws your scheduled monthly payment from your bank account, ensuring on-time payments and reducing the risk of late fees or credit score impacts.

7. How do I check my Kia Motors Finance balance?

You can log in to your online account portal to view:

Remaining loan balance

Payoff amount

Payment history

Due dates

Lease-end details

The portal is available 24/7.

8. Can I pay off my Kia loan early?

Yes. Kia Motors Finance does not charge prepayment penalties, which means you can pay off your loan early to reduce total interest paid. You can request a payoff quote in your online account.

9. What are Kia lease mileage limits?

Most Kia leases offer annual mileage options such as:

10,000 miles

12,000 miles

15,000 miles

Exceeding the allowed mileage may result in additional fees at lease end.

10. What happens at the end of my Kia lease?

At lease maturity, you can:

Return the vehicle

Buy the vehicle at a predetermined residual price

Start a new lease or finance a new Kia

A pre-return inspection helps identify any excess wear-and-tear charges.

11. Can I buy my Kia at the end of the lease?

Yes. Kia Motors Finance allows lessees to purchase their vehicle at the residual value listed in the contract. Many customers choose this option if the car is in great condition or market prices are high.

12. What is the residual value in a Kia lease?

Residual value is the estimated worth of the vehicle at the end of your lease. It significantly impacts your monthly payment—higher residual value usually means lower monthly costs.

13. Does Kia offer loyalty or incentive programs?

Yes. Kia frequently provides incentive programs including:

Loyalty discounts for returning customers

Military rebates

College graduate bonuses

Low APR promotions

Seasonal lease specials

These offers vary monthly.

14. Can I change or extend my Kia lease?

Kia Motors Finance may allow lease extensions if you need more time before returning the vehicle or waiting for a new model. Contact customer service or your dealership to request an extension and review terms.

15. Does Kia Motors Finance refinance loans?

KMF does not offer refinancing. However, you can refinance your Kia loan through a third-party lender like a bank or credit union if you want to reduce your monthly payment or interest rate.

16. What should I do if I miss a Kia Motors Finance payment?

If you miss a payment:

Log in to your account to make payment as soon as possible

Expect a potential late fee

Contact KMF if you anticipate further payment delays

Late payments may affect your credit score, so take action quickly.

17. Does Kia Motors Finance offer GAP insurance?

Many Kia dealerships offer Guaranteed Asset Protection (GAP) coverage through KMF. GAP covers the difference between your loan balance and the car’s actual cash value if the vehicle is totaled or stolen.

18. How do I contact Kia Motors Finance customer service?

Customers can contact KMF by:

Phone (varies by region)

Secure messages through the online portal

Mail correspondence

Visiting a local dealership for assistance

Phone support is generally the fastest method.

19. Can I transfer my Kia lease to someone else?

Lease assumptions or transfers may be allowed depending on the state and contract terms. Contact KMF directly to verify whether your lease is eligible for transfer.

20. How long does Kia Motors Finance approval take?

Approval is often instant for many applicants but may take several hours or days if manual review is needed. Online pre-approval typically speeds up the dealership visit.